How Does it Work?

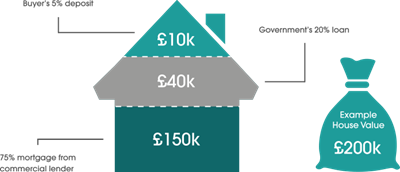

With a Help to Buy: Equity Loan the Government lends you up to 20% of the cost of your newly built home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest.

You won’t be charged loan fees on the 20% loan for the first five years of owning your home.

Example: for a home with a £200,000 price tag

If the home in the example above sold for £210,000, you’d get £168,000 (80%, from your mortgage and the cash deposit) and you’d pay back £42,000 on the loan (20%). You’d need to pay off your mortgage with your share of the money.

For more information (including advice on fees and paying back your loan) please download the Government’s ‘Help to Buy’ document:

https://www.helptobuy.gov.uk/wp-content/uploads/Help-to-Buy-Buyers-Guide-Feb-2018-FINAL.pdf

Who is eligible ?

Equity loans are available to first time buyers as well as homeowners looking to move. The home you want to buy must be newly built with a price tag of up to £600,000.

You won’t be able to sublet this home or enter a part exchange deal on your old home. You must not own any other property at the time you buy your new home with a Help to Buy: Equity Loan.

This scheme is available in England only.

How to apply ?

The Help to Buy: Equity Loan scheme is run by Government-appointed Help to Buy agents. They can guide you through your purchase, from providing general information about the scheme to dealing with your application.

Or look out for the Help to Buy logo on new-build developments and ask about the scheme there.

You can get more help and advice from the Money Advice Service and other useful contacts.

Find your local Help to Buy agent

Your local Help to Buy agent can guide you through the options available and explain the eligibility and affordability criteria. Help to Buy agents are appointed by Homes England.

Help to Buy agents administer the Help to Buy: Equity Loan scheme but not the mortgage guarantee scheme. They have the authority to give the go-ahead for you to purchase a home with help from the equity loan scheme. The agents make other key decisions during the purchase process. For the Help to Buy: Mortgage Guarantee, please contact the participating lenders directly.

How you access a Help to Buy: Equity Loan is changing …

From 2 January 2020, you can apply for an equity loan from one of three Help to Buy agents appointed to provide the scheme in England. They will support with your application for an equity loan.

Help to Buy agents offer support and guidance about equity loans and how to purchase your new build property. Agents offer support based on the geographical area that they cover.

What this means for you …

Depending on when you are due to complete your house purchase you may not be affected by any of the changes we are making.

If you are due to complete your house purchase before the end of December 2019, nothing changes. You will continue to receive support from your existing Help to Buy agent to complete the house buying process.

If your completion date has changed or you are due to complete from January 2020, we will automatically pass your details to the new agent to ensure your purchase continues to go through.